A voluntary bankruptcy filing involves taking legal action where an individual or business submits a petition to the court to organize their debts. This means that the filer purposefully initiates to seek relief from their financial obligations under the guidelines of bankruptcy law. A voluntary filing allows for the court to oversee a process that aims to resolve outstanding debts.

Beginning a Self-Filed Chapter 7 or Chapter 13

Navigating the intricacies of bankruptcy can be overwhelming. If you're considering filing for Chapter 7 or Chapter 13, it's crucial to understand the process and your options. While seeking legal counsel is always recommended, self-filing is a viable choice for some individuals. Before embarking on this path, ensure you diligently review all relevant federal bankruptcy laws and guidelines. A comprehensive understanding of these statutes is paramount to a successful filing.

- Gather all essential financial documents, including income statements, asset lists, and expense records.

- Complete the appropriate bankruptcy forms, which are available on the U.S. Bankruptcy Court's website.

- Pay the required filing fees, which vary depending on the type of bankruptcy you're seeking.

- File your completed forms and documents with the designated bankruptcy court.

Remember, self-filing requires meticulous attention to detail and a strong grasp of the legal aspects involved. Failure to comply with these guidelines can result in delays or even dismissal of your case. Proceed with caution and more info seek professional guidance if you encounter any obstacles.

Filing Control: Drafting Your Own Bankruptcy Petition

Facing overwhelming debt can feel like you're trapped in a maze with no exit. But bankruptcy, while often daunting, can offer a fresh start. If you're determined to take control of your financial future, submitting your own bankruptcy petition might be an option worth exploring. While it's not for the faint of heart, this path allows you {tooversee the process and potentially save on legal fees.

- Before diving in, however, understand that this route requires thorough research and a strong grasp of bankruptcy laws.

- It's crucial {to consult various resources, such as online guides and legal manuals, to confirm you fully comprehend the complexities involved.

- Moreover, be prepared for a potentially protracted process filled with paperwork and court appearances.

If you're determined to tackle this challenge head-on, remember that resources are available. The U.S. Courts website provides invaluable information on bankruptcy procedures, while non-profit organizations often offer free legal aid.

Embarking on Bankruptcy: A DIY Approach

Filing for bankruptcy can be a complex process, but it's possible to navigate it yourself. While consulting with an expert is always advised, there are resources available for those who choose a DIY approach.

First, you'll need to assess which type of bankruptcy applies your situation. There are two main types: Chapter 7, which involves selling assets to repay creditors, and Chapter 13, which enables you to formulate a settlement plan over three to five years.

Once you've chosen your type, you can begin the application process. This demands submitting various papers and furnishing filing fees. The forms can be obtained from the official bankruptcy court website.

Across the process, it's crucial to stay organized. Keep all your documents in a safe place and consult the instructions thoroughly.

Remember, while a DIY approach can be effective, it's important to be ready for the obstacles that may present themselves.

Embracing Voluntary Bankruptcy

Voluntary bankruptcy can feel like a daunting path, but understanding the process and its implications is crucial. Before filing, you must evaluate all other possibilities. Consulting with a qualified attorney can help you make an informed choice. Remember, voluntary bankruptcy aims to provide a fresh financial opportunity while managing your obligations effectively.

Representing Oneself in Bankruptcy Proceedings

Navigating the complexities of bankruptcy proceedings can present difficulties, especially for individuals unfamiliar with legal procedures. In many jurisdictions, debtors have the right to act as their own counsel in court, a process known as self-representation or pro se representation. While this option can offer financial benefits, it also demands a significant level of knowledge and preparedness. Effectively handling the intricacies of bankruptcy law requires careful investigation and a thorough understanding of legal language. Additionally, individuals for bankruptcy must comprehend their rights and obligations under the law, as well as the potential consequences of various filing choices.

Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Keshia Knight Pulliam Then & Now!

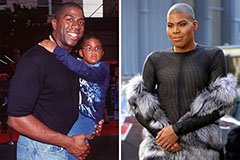

Keshia Knight Pulliam Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!